I’m a fan of anything that makes money management simpler and easier and targeted savings accounts fit the bill on both counts – simple and easy – especially when you throw automation into the mix.

I’m a fan of anything that makes money management simpler and easier and targeted savings accounts fit the bill on both counts – simple and easy – especially when you throw automation into the mix.

Through the use of targeted savings accounts we have paid cash for our last three (used) vehicles, can enjoy occasional travels without wondering how we are paying for the trip, and aren’t panicked when it’s time to pay our property taxes or replace vehicle tires. Targeted savings also allow us to take advantage of discounts for lump-sum payments on car insurance and bulk propane for our furnace.

Related: 3 Reasons You Should Pay Cash For Your Next Car

Needless to say, I’m a fan and using this approach has really made a difference for us and I want you to get on board too. So let’s dive in.

What is a targeted savings account?

A targeted savings account is just a basic savings account used for a specific purpose, sometimes referred to as a sinking fund.

Targeted savings accounts can be used for big-ticket items like vacations, vehicles, or home renovations or annual expenses that shouldn’t be a surprise but often sneak up on us (property tax, homeowner’s insurance, car insurance, Christmas and birthday gifts, or back-to-school shopping).

Related: 3 Easy Ways To Keep Your Christmas Shopping On Track

(Total aside: You can typically score pretty sizeable discounts for paying up front for your car insurance rather than opting for monthly payments.)

None of these expenses are surprises, at least they shouldn’t be. We all know they are coming – particularly annual events. As Dave Ramsey says, “Christmas is not a surprise.” It arrives every year just like clockwork.

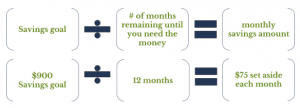

Setting aside cash every month sets you up for success and take the financial stress out of these one-time or once-a-year costs.Click To TweetComing up with $1,200 all at once on short notice can be daunting and may even feel impossible, but setting aside $100 per month is more manageable.

Why does it work?

Two words: consistency and automation

Consistency over the long haul is powerful. Saving consistently each month lets time work in your favor and takes the sting out of saving for big items. A little bit each month is way easier to handle than ‘catching up’ over just a few weeks.

Automation, thanks to online banking, is your friend and removes the need for discipline. We all have moments of faltering self-discipline and are prone to self-rationalizing decisions that do us more harm than good. With the help of automation, you do the initial setup and then monthly or weekly recurring transfers are made automagically without you thinking about it or debating on how much you should set aside this month.

Why a separate account for each purpose?

You might be thinking that you can accomplish this type of savings with just one general savings account. You’re right. You absolutely can, but it makes it harder to keep track of your progress. And remember, we are aiming for simple. I advocate for separate accounts for both simplicity and ease of course corrections throughout the year.

Simplicity

If you are saving for back to school shopping and for your next car insurance renewal and all the funds are in one account, after just a few months it’s easy to lose track of how much is saved for each purpose. When back to school time rolls around, at a glance you can’t tell how much you’ve saved to cover school supplies and how much is for insurance. I want easy. Look at the account, see that you have $300 bucks in there and you are ready to go. Worse yet, if everything is in one big account, it may even look like you “have plenty” in savings and then you decide to stop saving each month.

Give each account a name to remind you of its purpose. Most online banking platforms allow you to assign a name to each account. Use it to your advantage. It is so easy to log in and quickly see each of the savings account balances.

We use CapitalOne360 ←-referral link (you and I both get a bonus if you choose to open a qualifying account using the link) for all of our targeted savings accounts. We like it for ease of setting up new accounts, no fees, competitive interest rates, and the ability to set up free recurring automatic deposits into the accounts.

Setting it up once for the year and calling it a day is huge. Saves time and saves us from ourselves – no need to rely on self-discipline to make those savings transfers each month.

Easy Course Corrections

Easy course correction is another key reason to use separate accounts. We pay our property taxes annually and each January when we set up our base budget for the year we decide on an amount to save for property taxes which are due the following December. We make a guess based on the prior year’s assessment and any hunches we have about valuations going up or down for the coming year.

Let’s say we decide to save $2,400. Each September we receive an assessment notice with the actual property tax amount. When we get the notice, it is easy to do a quick check to see if we need to adjust our plans. If we have been saving $200 a month ($2,400 for the year) and learn in September that our actual bill is $2,000, we know we can ease up on that account for the rest of the year.

How To Get Started

- Start with one account to get a feel for it

- If you have school-age kids, a back to school shopping account can be an easy place to start.

- Open a savings account at a bank of your choice [CapitalOne360, Ally]

- Name the account

- Determine how much you need to save

- If you have irregular income, start with a base savings amount that is doable even in the skinny months and then make extra contributions during your higher earning months.

- Commit to your plan

- Automatic, recurring transfers – set it up and then keep your hands off

- After you get a feel for it with your first account, take steps to add more targeted saving into your monthly budgeting.

- Start small if you need to and build over time

Targeted savings is even more painless when you have a longer timeline. Planning a special trip after your daughter graduates high school three years from now? Start saving now to make it easy.

The content of strongerwallet.com is provided for general information purposes. Readers should not act upon the content or information without first seeking appropriate professional advice about their specific situation.

Never miss a post

Thanks for reading!

Subscribe to get my latest content delivered to your inbox.

Thanks for the wonderful article

I have to try this! Seems a great way to not over spend. thanks for the tips!

I thought this was simple and great. I’ve been thinking of the best way to save for car repairs, a newer car and vacation and this is perfect. Hopefully Discover Online does it as well.

I talk about vacation savings for Hawaii in my latest post on youngbudgeteer.wordpress.com and I think we think very similarly. Thanks for posting this!

Appreciate you reading the post. I find that simple is sometimes best, otherwise we tend to get in our own way and lose sight of our goals. Enjoy your vacation!

If tempted to withdrawal money from my targeted account before due date, can I. I ask this question because i don’t want access to that account until i meet my targets.

It’s your money – you can do whatever you wish. The idea is by having funds in separate accounts for specific purposes/goals there’s built-in accountability (it takes extra effort to access the funds so you will think more carefully about whether pulling the funds is necessary). Good luck!